Highest Taxed States 2025. The top rate drops to 5.84% for 2025, 5.2%. Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent.

What they are, how they work. In addition to paying federal taxes, many people around the nation also have to pay state income taxes.

While some states, including florida and new hampshire, are fortunate enough not to have state income.

Ranking Of State Tax Rates INCOBEMAN, The five states with the highest average combined state and local sales tax rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas. Wallethub identified the states with the highest and lowest tax rates by comparing the 50 states and the district of columbia across four types of.

These States Have The Highest Tax Burden In The US Zero Hedge, The ivory coast emerges as the highest taxed country, imposing an income tax of 60%, followed by finland, japan, austria, and denmark, each with a high income. Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent.

The 10 States With The Highest Tax Burden (And The Lowest) Zippia, Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. These are the 11 states that tax social security benefits in 2025 and are expected to do the.

Which States Pay the Most Federal Taxes A Look At The Numbers, Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. If we consider the revenue against inflation, the total revenue has decreased.

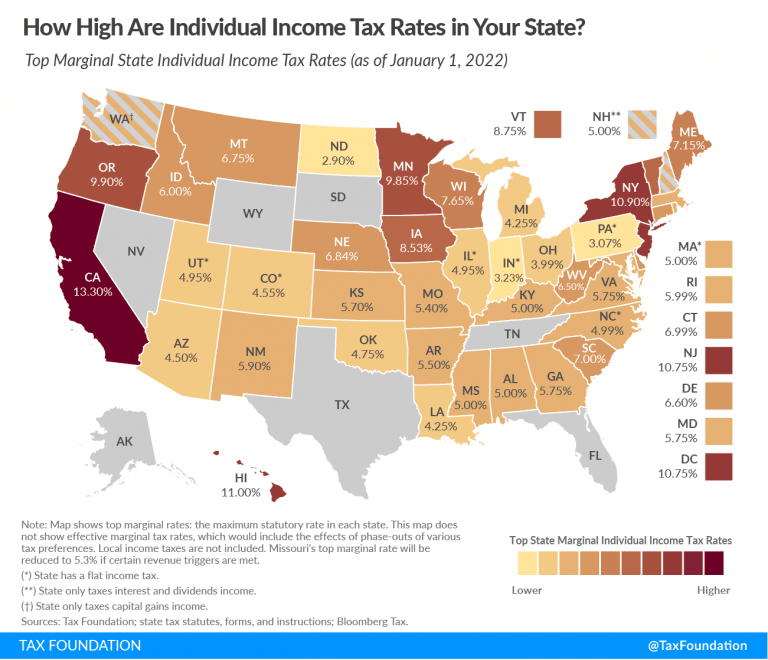

U.S. states with the highest and lowest tax rates, The ivory coast emerges as the highest taxed country, imposing an income tax of 60%, followed by finland, japan, austria, and denmark, each with a high income. In addition to federal income tax, most states also collect state.

Top State Tax Rates for All 50 States Chris Banescu, These are the 11 states that tax social security benefits in 2025 and are expected to do the. 10% 20% 30% 40% 50% 60% 70% 80% hover over a country for details.

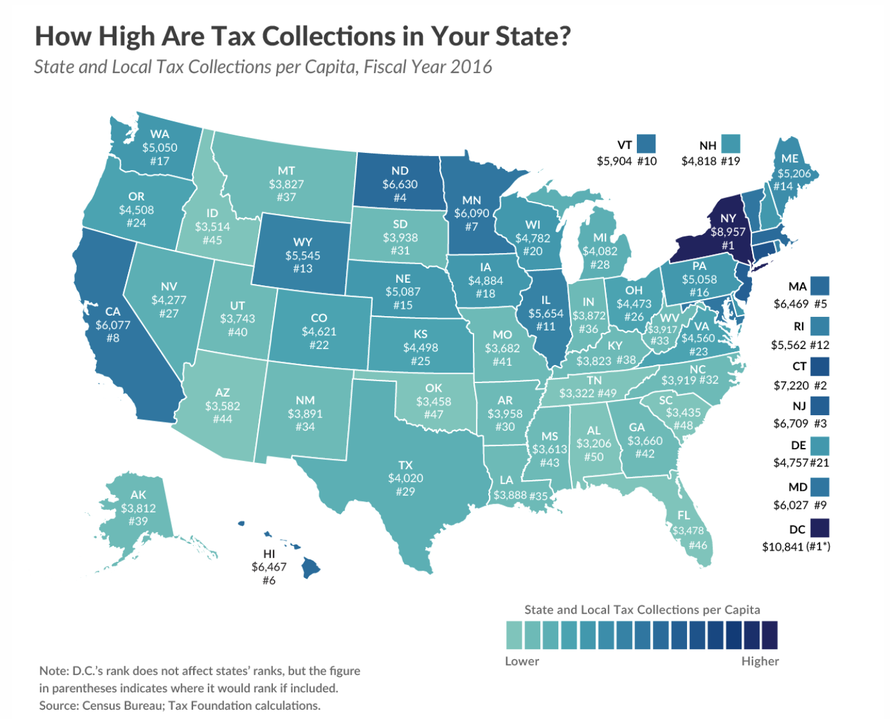

How High are Tax Rates in Your State?, The states with the highest burden for income tax are new york (4.72%), maryland (4.21%) and oregon (3.62%). 11.99% effective property tax rate (as share of annual income):

2025 state tax rate map Arnold Mote Wealth Management, The remaining five on this list of the top ten states with high tax burdens are new jersey (13.20%), illinois (12.90%), virginia (12.50%), delaware (12.40%), and. Tax rates by state 2025.

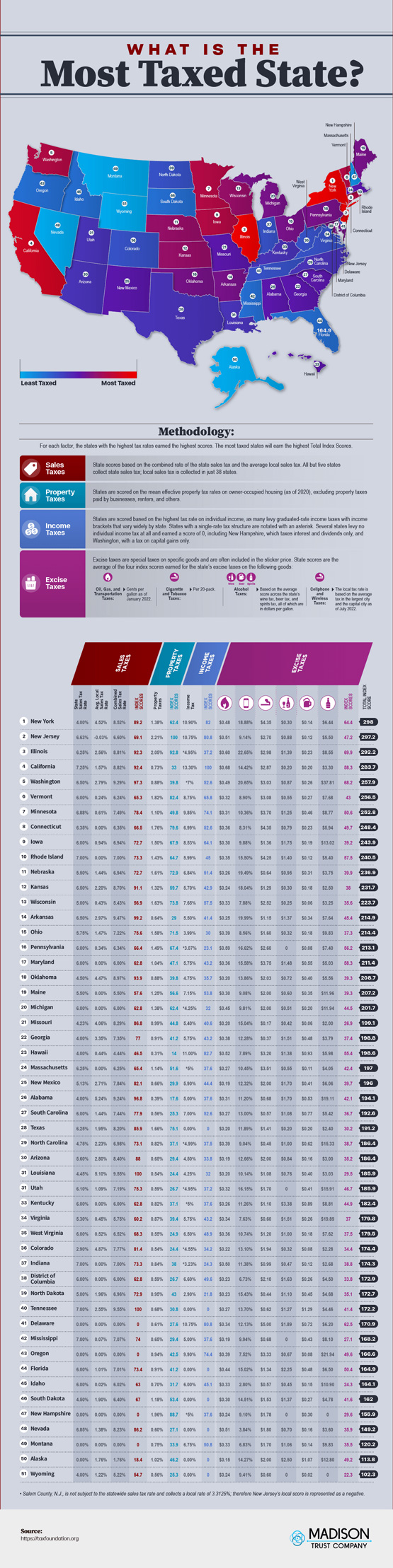

What Is the Most Taxed State? (Infographic) The AgencyLogic BlogThe, Wallethub pored through the array of taxes in the 50 states and the district of columbia to find where taxpayers take the biggest hit. 15 states with the highest income taxes in the us 15.

Highest Taxed States 2025 Wisevoter, Wallethub pored through the array of taxes in the 50 states and the district of columbia to find where taxpayers take the biggest hit. 3.28% effective vehicle tax rate:

In addition to paying federal taxes, many people around the nation also have to pay state income taxes.

Wallethub identified the states with the highest and lowest tax rates by comparing the 50 states and the district of columbia across four types of.